You may have heard that if you are a Spanish Tax Resident, you have the obligation to inform the assets you may have abroad if the value is over 50,000 Euros. If so, you’ve been informed correctly! If you find yourself wondering about the specifics, read on for the details of the 720 Form.

(Updated by Lexidy Staff 11/2023)

Table of contents

- 1. Form 720 in Spain : What is it?

- 2. Who is required to file Form 720 in Spain?

- 3. In what cases do I need to file Form 720 in Spain?

- 4. Who is exempt from filing the form?

- 5. Is there a deadline to file Form 720 in Spain?

- 6. Where do I file it?

- 7. If I already filed it before, do I need to do it again?

- 8. What assets and information need to be included in form 720 in Spain?

- 9. What happens if I forget to submit the form?

- 10. Is it true that the EU court has declared the penalties for not filing Form 720 void?

- Can Lexidy help me with filing Form 720?

1. Form 720 in Spain: What is it?

Form 720, or “Modelo 720,” is a declaration form for overseas assets, introduced by the Spanish Tax Authorities in 2012 to encourage the disclosure of previously undeclared foreign assets.

Initially, it was a way to regularize past undeclared assets without penalties, but failing to accurately declare assets on Form 720 can result in significant fines.

The good news is that this form is informational and doesn’t incur immediate payment. That said, whatever you declare on the form will impact your Personal Income and Wealth Tax Returns.

Essentially, the key takeaway here is the importance of being transparent about foreign assets in your tax filings.

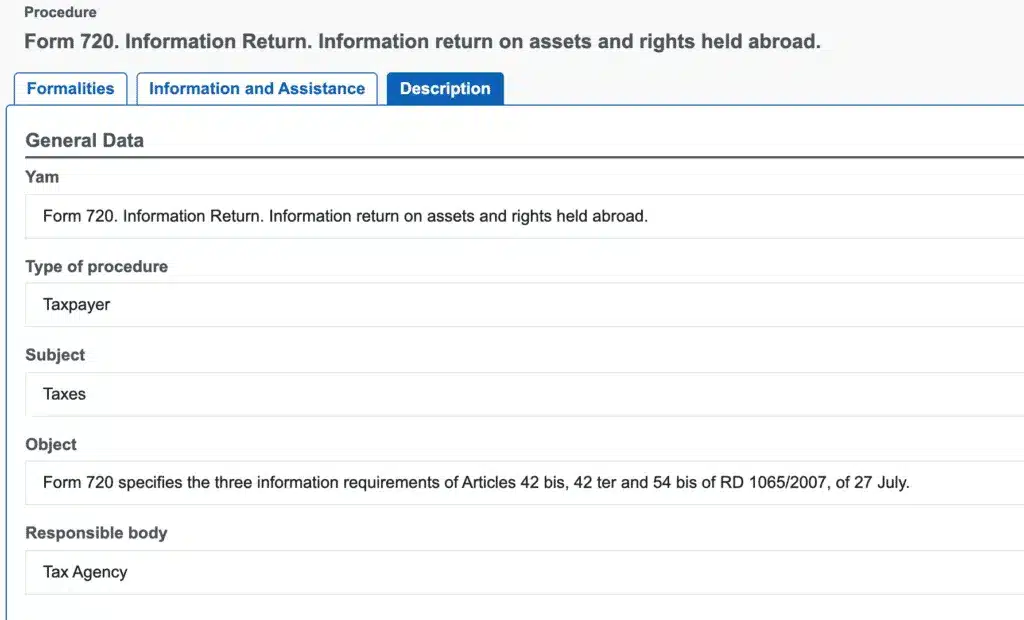

Example of Form 720:

2. Who is required to file Form 720 in Spain?

Taxpayers classified as Spanish Tax Residents are required to file Form 720.

You might be wondering “What is a Spanish tax resident?” Well, if you spend more than 183 days in Spain within a calendar year, counting from January 1st to December 31st, then you are considered a Spanish tax resident. This period includes any time spent abroad for work or holidays.

It’s also important to note that if your spouse and dependent children are Spanish Tax Residents, the tax authorities will typically consider you a Spanish Tax Resident as well unless you can demonstrate otherwise.

Furthermore, if circumstances, such as illness or a pandemic lockdown require you to stay in Spain beyond 183 days, the tax authorities will still consider you a Spanish Tax Resident. Essentially, you must file Form 720 in Spain when you meet the criteria.

Need tax advice? Get a free consultation with our tax lawyer. Our passionate, experienced legal team will make sure you receive the attention you need for your unique situation.

3. In what cases do I need to file Form 720 in Spain?

In general, you are required to declare your assets if your total value exceeds 50,000 Euros in one of the following categories:

- Foreign Bank Accounts: Money in banking institutions abroad.

- International Investments: Securities representing equity in foreign entities.

- Overseas Real Estate: Property abroad, including any rights associated with them.

The filing requirements are as follows:

- Single Category Over 50,000 Euros: You must file Form 720 for that category.

- Multiple Categories Over 50,000 Euros Each: You must file Form 720 including all assets from every category.

It’s crucial to be accurate and thorough. Misreporting or underreporting can lead to significant penalties. So, keep track of your assets and ensure you’re fully compliant with these reporting requirements

4. Who is exempt from filing the form?

If you’re covered by the Special Expatriate Tax Regime (often referred to as the Beckham Law), you’re off the hook for filing Form 720. But, keep in mind, this doesn’t extend to your spouse. The Beckham Law benefits the individual taxpayer, so they may still need to file it.

Remember, the need to file Form 720 kicks in when you own assets or rights abroad. This includes cases where you’re a legal representative or the ultimate beneficiary of assets held in trust companies.

5. Is there a deadline to file Form 720 in Spain?

You must file the Informative Form on Goods and Assets Abroad (Form 720) between January and March following the end of the tax year.

For example, if you’re a Spanish Tax Resident in 2023, you need to file Form 720 from January 1st to March 31st, 2024.

6. Where do I file it?

You should submit Form 720 online through the Spanish Tax Authorities’ website.

Quick tip: Make sure to familiarize yourself with the filing process. Any errors can result in costly penalties.

7. If I already filed it before, do I need to do it again?

Not always! You’re only required to refile if the value of any of the three asset groups has increased by 20,000 Euros or more since your last filing.

8. What assets and information need to be included in form 720 in Spain?

Foreign Bank Accounts:

- Bank’s name and address.

- Full account details (including type, identification, and opening/closing dates).

- Balances on December 31st and average for the last quarter.

- Ownership percentage.

- Note: You must declare even if you’re just an authorized user.

Securities and Investments Abroad:

- Shares, insurance policies, and annuities (both temporary and lifetime) managed or obtained abroad.

- Securities for trusts or collective investment institutions abroad.

- For each category:

- Business name and address of the entity.

- Details on December 31st (number, class, value of shares; redemption or capitalization value for insurance and annuities).

- ISIN of shares or investments.

Real Estate and Rights on Them Abroad:

- Property identification details.

- Location (country, city, street, and number).

- Acquisition date and value.

- Percentage of ownership.

- Special rules apply for usufruct, bare ownership, and multiple ownership situations.

To know more about Rights on Real Estate abroad, read 4 Main Tax Implications to consider in Spanish Real Estate.

9. What happens if I forget to submit the form?

While Form 720, which reports assets held abroad, is essentially informative and doesn’t directly determine your tax liability, it’s crucial to understand that failing to file this form or filing it with incorrect information, can lead to serious consequences.

Some of these consequences include:

Penalties for Non-Compliance with Form 720 in Spain:

- Missing or Incomplete Information: Each piece of missing or incomplete information on Form 720 incurs a hefty penalty of 5,000 Euros. For inaccurate or partially filled information, the minimum penalty is 10,000 Euros.

- Late Filing: If you file Form 720 after the deadline without a prior request from the Spanish Tax Agencies, there’s a penalty of 100 Euros for each piece of data or set of data, subject to a minimum of 1,500 Euros.

Implications on Personal Income Tax and Wealth Tax

- Unjustified Capital Gains: If the Spanish Tax Authorities discover unreported foreign assets, they treat them as non-justified capital gains. In addition, this gain will be added to the latest unexpired Personal Income Tax Return or Corporate Income Tax for the taxpayer.

- Tax Rates and Additional Penalties: Unreported assets are subject to progressive taxation, ranging from 19% to 26%. In addition to the tax owed, they will charge you interest on late payments at an annual rate of 3.75%. Furthermore, there’s a 150% penalty on the unpaid tax amount.

These stringent measures underline the importance of accurate and timely filing of Form 720 to avoid significant financial repercussions. It’s better to be prepare yourself fully and be transparent so you don’t face any unexpected penalties down the road!

10. Is it true that the EU court has declared the penalties for not filing Form 720 void?

Yes, the European Union (EU) Court has ruled that the penalties for not filing the Spanish Tax Return (as per the Appeal against Spain on October 23rd, 2019, and other cases) are disproportionate and should be void.

Also, this was also supported by the Supreme Court of Justice of Extremadura’s ruling on February 27th, 2020. However, despite these rulings, the Spanish Tax Authorities continue to enforce these penalties.

So, if you choose not to file Form 720 relying on these EU Court decisions, you most likely will have to pay penalties. The authorities may seize your accounts, and you may need to engage in legal proceedings for at least three years, awaiting review by the EU Courts.

Can Lexidy help me with filing Form 720?

Take advantage of the tax consultancy at your disposal to assist you and make the process much easier. Taxes are complex, that is for sure. But, with the right help, they can be much simpler.

Our team of experienced tax lawyers in Spain will help you with any request to save you time, money, and unnecessary work. Fill out the form below to get started!