Dual Citizenship in Mexico: 2026 Requirements, Process & Key Advantages

Secure Mexican dual citizenship. Learn about requirements for descent, marriage, and residency, plus advantages for US citizens holding two passports.

Stay ahead with the latest legal insights and updates for stress-free living.

You can also search for the news you want:

Secure Mexican dual citizenship. Learn about requirements for descent, marriage, and residency, plus advantages for US citizens holding two passports.

Learn how to obtain Greek citizenship by residence in 2026. Discover the naturalization path, language requirements and application process.

Compare the cost of living in Mexico. See average rent, grocery prices, and healthcare costs. Find the most affordable cities for expats.

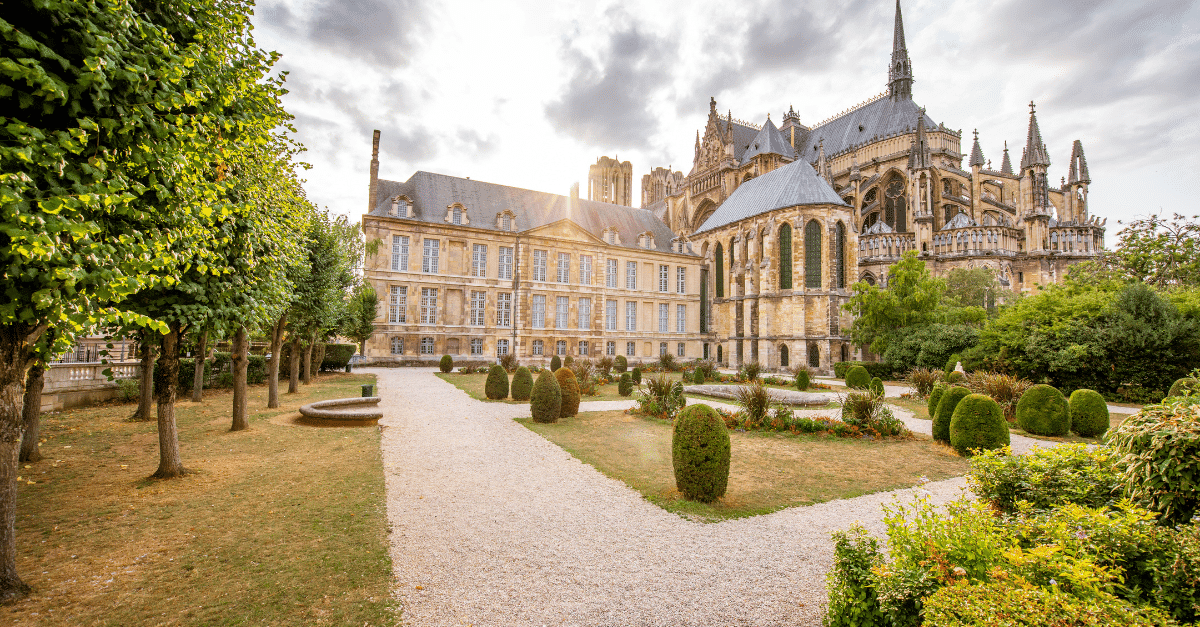

Thinking of living in France as an American? Discover 12 honest pros and cons, cost of living data, and quality of life insights from real expats in 2026.

Compare living expenses in Greece. See average rent, grocery prices, and healthcare costs vs. the US. Find the most affordable cities for expats.

Explore living costs in Italy in 2026. Compare average rent, grocery prices, and salaries vs the US. Find the most affordable places for expats.

Learn how to obtain French citizenship by descent through direct lineage. Uncover the benefits and the 2026 requirements of this process.

The Digital Nomad Visa (D8) leads directly to Permanent Residency in Portugal after 5 years. Learn the minimum stay rules, A2 language test, and the path to citizenship.

UK citizens moving to Portugal post-Brexit must apply for a visa. Learn the best routes (D7, Digital Nomad), financial requirements, and the step-by-step process.

The 2025 guide to the EU Blue Card in Spain. Check updated salary requirements, application steps, and the key differences from the Highly Qualified permit.

Explore the France work visa for UK citizens. Learn about the Talent Passport route and key requirements for skilled workers in France.

Unlock the path to permanent residency in Spain with the digital nomad visa. Discover how it can benefit your long-term plans.

Step confidently into your international future, armed with clarity and supported by expert legal guidance every step of the way.